Every day, in various places around the world, luxury goods such as artworks, jewelry, watches, and wine are put up for auction and sold. The sums moving around the art market are particularly large. In 2013, a painting attributed to Leonardo da Vinci, Salvator Mundi, was purchased by Swiss businessman Yves Bouvier for US$80 million. The next day, he sold the painting tax-free in a freeport to Russian businessman Dmitry Rybolovlev for US$1億2,750万. Four years later, in 2017, a buyer believed to be acting on behalf of Saudi Crown Prince Mohammed bin Salman purchased the painting at a New York auction house for US$4億5,030万. It is still known as the most expensive painting ever sold.

Attention then turned to the painting’s whereabouts. Although it was scheduled to be exhibited at the Louvre Abu Dhabi, it never went on display there and its trail went cold. Because New York State sales tax was not paid on the purchase, some have speculated that it was moved to a freeport. What exactly is a freeport?

A freeport is a “port” where stored goods are deemed to be in transit and are not subject to customs duties. “Port” here refers to a gateway into a country or region and is not limited to seaports. It is said that there are around 3,500 freeports worldwide. One was also established in Luxembourg, the richest country in the world, in 2014 by the aforementioned Bouvier. What are freeports for, who benefits from them, and what problems do they entail? This article takes a closer look at freeports, focusing in particular on Luxembourg.

A Christie’s fine art auction held in Hong Kong in autumn 2011 (Photo: manhhai / Flickr [CC BY-NC 2.0])

目次

What is a freeport

First, a brief explanation of what a freeport is. Freeports are usually built near seaports or airports, and are equipped to immediately store shipments arriving from other countries. Because stored goods are deemed to be in transit, they become taxable only when they leave the freeport premises and formally enter that country or another. As a result, fine art and other luxury goods can be traded and stored indefinitely in some freeports, and while they remain there, there is no obligation to pay customs duties or other taxes—an arrangement that makes it possible to legally avoid taxes.

So what are the benefits of freeports and who gains from them? Freeports temporarily store not only luxury goods in transit but also resources and machinery parts. In addition to storage, it is also possible to process them on site before exporting.

This benefits companies. As the globalization of economic activity has advanced, international division of labor and entrepôt trade are increasingly used to maximize profits. Freeports are useful to companies in these cases. For example, for machine parts manufactured in one country and destined for another, if a transiting country has a freeport, storing, assembling, and processing them there tax-free allows for tax avoidance.

Why, then, do countries allow the establishment of places where goods can be stored tax-free? The goal is to promote economic activity such as manufacturing and trade in the area by using them as temporary storage for goods in transit. The argument is that by attracting a great deal of trade to a freeport, economic activity within it leads to jobs and investment, and companies around the freeport become more active to support that economic activity—a claim underpinning the policy.

A freeport in Malta (Photo: NAC / Wikimedia Commons [CC BY-SA 4.0])

Why do users store luxury goods in freeports? In general, profits from the sale of artworks are income to the seller and are taxed according to each country’s rules. However, freeports offer tax advantages, and when transactions take place within the facility, goods can be bought and sold tax-free without notifying the fiscal authorities of the buyer’s or seller’s home country. Thus, storing and trading luxury goods within a freeport leads to tax savings. One might say storage alone would limit how they can be used, but in reality, freeports can be used not only to store luxury goods but also to hold wine tastings and exhibit artworks, turning them into a private museum of sorts.

The history of freeports

There is still debate over how freeports came into being. One account says they developed in what is now Italy during the waning of the Renaissance. In the competition to attract trade from the rapidly growing Atlantic world, several states opened their ports to foreign merchants. Such ports became known as places where merchants could do business with minimal interference from state authorities. They later spread to other parts of Europe, to the Caribbean in the 18th century, and to the rest of the world in the 19th and 20th centuries.

Although freeports emerged along this path, as noted earlier, many have since transformed into repositories for high-end goods. How did their use change?

The world’s first freeport for artworks is said to have begun at the Geneva freeport (Port Franc), with origins dating back to 1888. Its initial purpose was to store goods in transit—especially grain, tea, and industrial products—temporarily in a tax-free location. In the late 20th century, however, art collectors, lawyers, and investors noticed that the time goods could remain “in transit” was unlimited and began changing how they were used. Thus were born freeports as tax-free high-end warehouses where artworks, jewelry, wine, and other alternative assets could be stored and traded indefinitely while appreciating in value. By offering storage without time limits, freeports found a use that departed from their original purpose of temporarily storing goods in transit.

The Geneva freeport (Port Franc) (Photo: Guilhem Vellut / Flickr [CC BY 2.0])

Today, this largest and oldest freeport in Geneva houses 1.2 million works and is described as “the largest art collection that no one can see.” The total value of the assets gathered there is estimated at around US$80–100 billion. Considering that the Louvre in Paris holds 380,000 works of art and displays 35,000 of them, one can appreciate just how enormous this freeport is.

The number of freeports worldwide grew from about 79 in 1975 to about 3,500 in 2023 overall. Today, freeports exist not only in Geneva, Switzerland, but also in Luxembourg, Singapore, the United Arab Emirates, Hong Kong, and various other countries and regions.

Problems lurking in freeports

What issues do freeports present? While tax avoidance itself is legal, it means reduced tax revenues for governments. The beneficiaries are the wealthy. Questions have been raised as to why exemptions within freeports from value-added tax (VAT) (※1), capital gains tax (※2), sales tax, and the like—introduced as measures to promote trade—should also apply to the semi-permanent storage and trading of high-end goods at all.

Moreover, the freeport system creates the potential for not only tax avoidance but also crimes such as tax evasion and money laundering. As noted above, within a freeport goods can be bought and sold without the buyer or seller notifying their home country’s fiscal authorities. The secrecy of such transactions makes it easier for individuals or importers to falsify invoices and other records to manipulate prices and engage in tax evasion or money laundering.

Corridor inside the freeport in Luxembourg (Photo: Bdx / Wikimedia Commons [CC BY-SA 4.0])

Money laundering is the concealment of the source of criminal proceeds to disguise their illegal origin, or making it appear that such proceeds were obtained through legitimate transactions. There are many methods of money laundering. Among these, trade-based money laundering (TBML) is particularly likely to occur in freeports. The Financial Action Task Force (FATF), an international body, defines TBML as “the process of moving value through trade transactions in order to disguise the origin of criminal proceeds and to legitimize their illicit origin or to finance activity.” In freeports, goods can be stored without disclosing the true owner by recording only the name of the agent responsible for disposing of the inventory when items are brought in. By exploiting this, along with the fact that transactions can be conducted without the knowledge of fiscal authorities, someone can purchase art with illicit funds, bring it into a freeport without leaving a personal trace in the records, and sell it to others, making it difficult to identify the source of the funds.

Are there countermeasures against such crimes? The European Union’s Fifth Anti-Money Laundering Directive (AMLD5), introduced in 2018, amended previous directives and expanded the scope of institutions required to comply. Freeports are now included. This requires freeports to carry out customer due diligence, report suspicious transactions, and record beneficial ownership information. All EU member states were required to transpose these requirements into national law by 10 January 2020.

Luxembourg and tax havens

From here, we take up Luxembourg—where a large freeport has been introduced—as a case study. Luxembourg is a very small country, with an area of 2,586 square kilometers and a population of 634,730. However, in terms of gross domestic product (GDP) per capita (※3), Luxembourg is the richest country in the world. Why is it so wealthy?

One factor is its status as a tax haven with preferential tax treatment. A tax haven is generally a country or region that applies no or low corporate tax rates to foreign companies. For countries and regions that become tax havens, the large volumes of money flowing through them can result in substantial revenue from the relatively small taxes and fees companies do pay. Many foreign companies and individuals set up shell companies or branches in tax havens to take advantage of the zero or low tax rates and channel money earned elsewhere. Luxembourg is one of the best-known tax havens, so capital funneled in from abroad may be included in Luxembourg’s GDP just like income actually generated there might be.

In addition, Luxembourg has a high proportion of cross-border commuters who contribute to creating wealth in Luxembourg but are not included when dividing GDP by population. Together, these factors yield a very high GDP per capita for Luxembourg.

Next, why is Luxembourg regarded as a tax haven? Luxembourg is popular with companies considering issuing bonds because it has no withholding tax (※4), no stamp duty (※5), and no requirement to issue a prospectus (※6). However, Luxembourg’s effective tax rate (※7) was 21.8% as of 2022, the 9th highest among the 27 EU member states. Why, then, do multinationals cluster there? One reason was revealed by LuxLeaks.

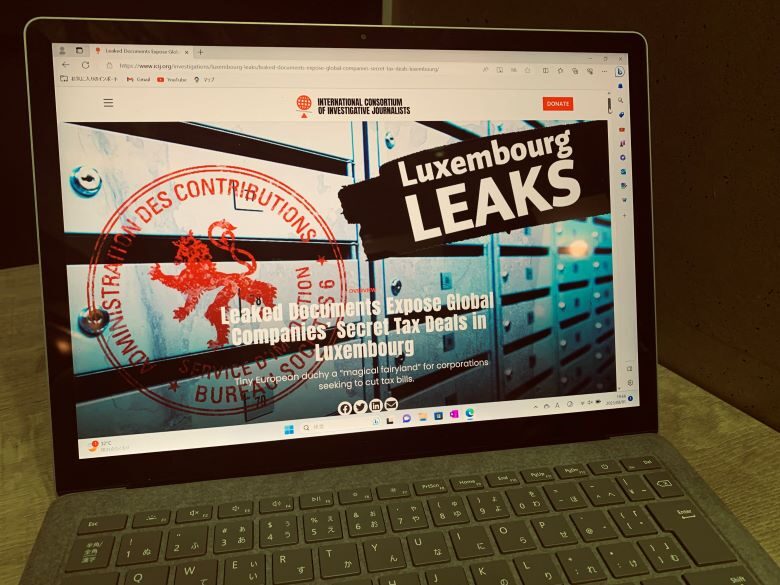

In 2014, a leak to the International Consortium of Investigative Journalists (ICIJ) revealed that Pepsi, IKEA, FedEx, and 340 other multinational firms had struck secret deals with the Luxembourg government to drastically cut their taxes. These companies appear to have saved billions of dollars by shifting profits from high-tax countries where they were headquartered or did substantial business to lower-tax Luxembourg. While Luxembourg’s average effective tax rate from 2009 to 2014 was about 25%, leaked records show examples where the effective tax rate on profits shifted to Luxembourg was under 1%.

ICIJ’s website on LuxLeaks (Photo: Nozomi Kishibuchi)

According to the leaked documents, PricewaterhouseCoopers (PwC), one of the Big Four accounting firms, prepared proposals seeking special tax rulings on corporate structures and transactions to help client companies save taxes, and negotiated them through private meetings with Luxembourg tax officials. Reviews that can take up to six months were often approved in one day (※8).

Luxembourg and freeports

Though long targeted as a place where tax avoidance is possible, Luxembourg opened a freeport in September 2014. Finance originally accounted for a very large share—35%—of Luxembourg’s GDP. However, the 2008 financial crisis made people aware that they could lose deposits if a bank failed, which in turn increased demand for tangible assets like art and gold instead. Against this backdrop, the Luxembourg government set its sights on the arts to diversify its economic base and reduce reliance on finance overall. This led to the construction of a freeport, which would attract luxury goods from around the world and generate economic impact. In addition to finance, Luxembourg’s logistics sector is thriving, and its ability to provide safe, convenient transport also contributed to the decision to build a freeport.

For its construction, the aforementioned Swiss businessman Yves Bouvier, former head of Geneva art logistics firm Natural Le Coultre, made a major investment. A leading figure in the freeport world, he also worked on the freeports in Singapore and Shanghai. Negotiations between Bouvier and the government led to the enactment of a law under which goods within the facility would not incur customs duties. The government did not spend public funds, but provided the construction site free of charge and arranged the tax regime. In this way, the freeport project in Luxembourg moved forward.

What are the features of the completed Luxembourg freeport? Initially called Le Freeport, in 2021 it was renamed the Luxembourg High Security Hub (Luxembourg HSH) instead. Roughly the size of three soccer fields, it includes four bullion vaults and storage space for 750,000 bottles of wine. There are only a few entrances, one for people and the rest for stored items. About 300 surveillance cameras are installed, and security is strict. The facility sits next to the runway of Luxembourg Findel Airport, used by private jets and special cargo planes. The advantage for customers is that items stored or sold there are not subject to import duties, VAT, or capital gains tax (※9).

Are measures in place at the Luxembourg freeport to prevent misuse? Currently, in Luxembourg, three customs officers are stationed at the freeport to prevent illegal acts and check all incoming items against databases of stolen goods. This may help prevent money laundering via the sale of stolen items inside the facility. However, while customs checks may detect stolen property, in practice there are limits to distinguishing artworks purchased with illicit funds, tracing their owners, or investigating whether prices are being manipulated.

In 2015, Bouvier was arrested on suspicion of defrauding Rybolovlev by manipulating the sale prices of dozens of artworks, including the painting mentioned at the beginning. The fraud allegations against the main investor in Luxembourg’s freeport undermined confidence and further heightened suspicions that crimes were being committed there. Bouvier denied all charges and prevailed in Monaco’s courts in 2019, but in the aftermath Luxembourg strengthened its anti-money-laundering regulations. Since 2015, three logistics companies authorized to operate at Luxembourg HSH have been required to record and retain information on the ultimate beneficial owners of assets stored in the warehouses.

As a result, Luxembourg is said to be the only country that requires freeports to implement anti-money-laundering measures akin to those imposed on financial institutions. With the introduction of such laws, one of the features of freeports—secrecy—has been diminished, placing Luxembourg HSH at a competitive disadvantage relative to other freeports; according to one logistics operator at Luxembourg HSH, as many as 30 clients moved their assets elsewhere as a result.

Conclusion

This article has explained, focusing on Luxembourg, how tax avoidance works, the characteristics of freeports, and the risks of illegality and crime they entail. While there is debate in Luxembourg over whether crimes are being committed at its freeport, the European Parliament appears to believe the Luxembourg freeport still carries a money laundering risk. Meanwhile, government officials and freeport representatives in Luxembourg maintain that the freeport complies with the law.

Inside Luxembourg HSH (Photo: Bdx / Wikimedia Commons [CC BY-SA 4.0])

Freeports, whose appeal lies in secrecy, are being asked to provide a level of transparency that is at odds with that trait. And the concerns are not limited to criminal conduct. As noted, the fact that various tax exemptions extend to high-end goods stored almost permanently and to their transactions raises questions about whether this contradicts the original goal of promoting trade. Companies and individuals will use every means to avoid taxes, but that leads to the loss to governments of tax revenues that would otherwise have been collected. The loss of tax revenue appears to affect not only Luxembourg but countries around the world. We will be watching developments closely.

※1 Value-added tax (VAT): an indirect tax levied on purchases of goods and services in countries such as those in the EU and parts of Asia. Rates vary by country. EU member states are required to implement VAT.

※2 Capital gains tax: a tax levied on income from the transfer of stocks, real estate, and securities.

※3 GDP: the total value added of goods and services produced domestically over a given period.

※4 Withholding tax: “a tax an employer deducts from an employee’s gross wages and pays directly to the government.”

※5 Stamp duty: a tax imposed by a government on legal documents related to the transfer of real property and other assets.

※6 Prospectus: “a document delivered to investors when soliciting subscriptions for or sales of securities; it explains the issuing company and the securities being offered. When an issuer sells securities, it must prepare and deliver a prospectus to investors.”

※7 Effective tax rate: a corporation’s actual income tax burden as a percentage.

※8 Luxembourg’s Ministry of Finance argues that advance negotiations on tax rulings also take place in many EU member states, including Germany, France, the Netherlands, and the UK, and that as long as this remains the case, they do not violate European law.

※9 Another feature within Luxembourg’s freeport is reduced insurance premiums for insuring luxury goods. In the “Global Risk Assessment Platform” run by the French insurer AXA, which evaluates buildings around the world for safety and security, the freeport scored a high 99.6% in 2017, allowing clients’ premiums to be cut in half. In addition, when artworks are restored, specialists come into the freeport to perform the work, eliminating the need to transport items outside.

Writer: Nozomi Kishibuchi

Graphics: Yudai Sekiguchi

0 Comments