The world’s lightest metal, lithium, is currently experiencing a surge in demand worldwide. Lithium is used in glass and ceramics, as well as in rechargeable lithium-ion batteries, which are used in mobile phones, computers, and hybrid and electric vehicles.

Over the ten years from 2006 to 2016, the price of lithium rose to about three times its previous level. Demand for lithium is expected to continue increasing for batteries used not only in hybrid and electric vehicles and smartphones, but also in renewable energy such as solar power, and companies in various countries are focusing on securing these resources.

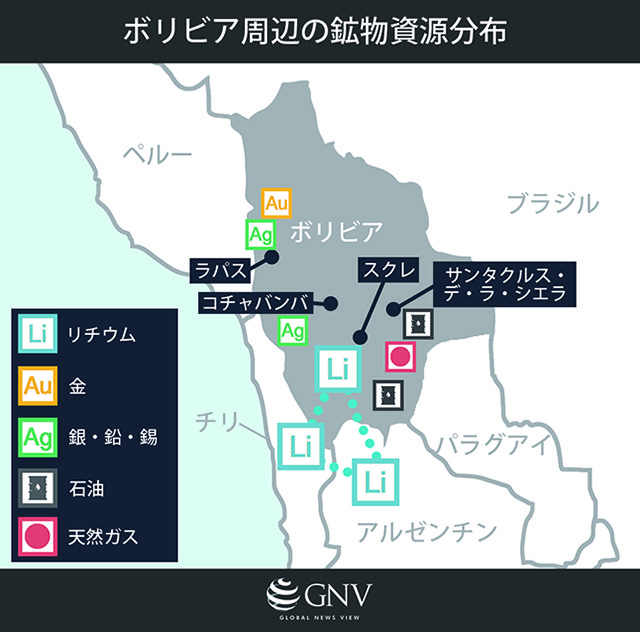

So where is lithium produced? Today, major producers include Australia, Chile, and China, but it is estimated that about 70% of the world’s total reserves are found in three South American countries: Bolivia, Chile, and Argentina. The lithium-producing regions of these three countries are known as the Lithium Triangle, and among them, Bolivia’s Salar de Uyuni is the world’s largest lithium deposit, said to contain about 50% of the world’s total lithium reserves.

Salar de Uyuni has not yet been developed, and to meet the world’s future lithium demand, developing this deposit is essential. However, various upheavals are unfolding over the vast lithium buried in Bolivia.

Salar de Uyuni (Photo: Ksenia Ragozina /Shutterstock.com)

Bolivia is a country located in the central part of the South American continent, blessed with abundant natural resources such as heavy metals like gold and silver, as well as oil and natural gas. Yet, paradoxically, it is also one of the poorest countries in Latin America.

Explanatory map: sourced from mapcruzin and siteselection

President Evo Morales, who has served as Bolivia’s president since 2006, sees lithium as the key to economic growth and intends to carry out everything domestically, from lithium extraction to battery production, announcing that he would invest $995 million in lithium development by 2019.

In developing mines in developing countries, foreign companies are often involved, and in such cases it is no exaggeration to say that most of the profits flow to the companies. In fact, despite the soaring values of mineral resources in recent years, this has not been reflected in the profits of Latin American countries that own the mines. While this profit distribution is formally agreed upon between governments and companies, the balance of power between foreign corporations and the Bolivian government often results in distributions that favor the companies.

Even more problematic is illicit financial outflows. Foreign corporations engage in tax evasion by routing transactions through related companies in tax havens or by using trade misinvoicing, thereby siphoning off taxes that should be paid to developing countries. Although this issue receives little attention, on a global scale, illicit outflows from the poorest and developing countries far exceed the level of official development assistance (ODA) provided by developed countries. Over the ten years from 2003 to 2014, the amount estimated to have flowed illicitly out of Bolivia was about $6.2 billion.

While this is an enormous sum, it is by no means large compared to other Latin American countries such as Chile and Argentina. If foreign companies were to take charge of lithium development in Bolivia, this amount would likely swell. Given the current prevalence of unfair profit distribution and illicit financial outflows, development carried out by foreign corporations is extremely disadvantageous for developing countries.

Graph: Created based on data from Global Financial Integrity (GFI)

In the past, Bolivia also experienced an incident known as the “Water War”, in which privatizing the water services in the city of Cochabamba under a foreign company caused water rates to more than double. In light of such precedents, President Morales seeks domestic development so that profits from lithium are returned to his own country.

At first glance, pursuing development domestically appears to be the best option for Bolivia, but opinions within the country are divided. As mentioned above, Bolivia is one of the poorest countries in Latin America and is said to lack the capital required for large-scale lithium development. In August 2016, miners staged protests calling on the Bolivian government to ease mining regulations and allow foreign companies to enter, and a deputy interior minister who had been negotiating was killed. Their demands likely stemmed from the expectation that an influx of foreign capital would raise wages.

Beyond capital, there are also concerns about environmental destruction caused by development. Bolivia has already seen environmental problems such as soil contamination, water pollution, and air pollution around mines due to the extraction of heavy metals like gold and silver arise around mining areas. Moreover, extracting lithium—found in regions scarce in water—requires large amounts of water, posing a high risk of depletion and contamination of water resources. Any development must proceed with measures to prevent environmental pollution in mind.

Bolivia’s lithium development is entangled with structures of exploitation by developed countries, environmental issues, and labor issues, and it also encompasses domestic problems not discussed here, such as inequality and ethnic conflict.

A variety of factors are intertwined, making the issues more complex, but by unpacking them we can catch a glimpse of the structure of problems brought about by globalization.

The turmoil surrounding Bolivia’s lithium is far from over. We will continue to watch how things develop and consider what constitutes the best approach to development.

Writer: Mai Ishikawa

Graphics: Mai Ishikawa

0 Comments