In 2020 October, Justin Bgoni, CEO of the Zimbabwe Stock Exchange (ZSE), indicated a positive stance toward listing cryptocurrencies, including Bitcoin. Cryptocurrency is encrypted electronic data and a currency that can be used for transactions on the internet. While the Zimbabwean government’s attitude toward this move by the ZSE remains somewhat unclear, the use of such cryptocurrencies has been increasing in Zimbabwe in recent years. What lies behind this trend? And what changes might cryptocurrencies bring to Zimbabwe’s economy? This article explores these questions.

目次

History of Zimbabwe

Behind the growing use of cryptocurrency in Zimbabwe is the country’s dire economic situation. To understand why Zimbabwe fell into economic crisis, we must first look back at its history. Zimbabwe was once a British colony called Southern Rhodesia. Many settlers came from Britain and came to monopolize local farmland. At that time, a minority white government ruled Southern Rhodesia. In the 1960s, as colonies across Africa gained independence one after another, it became only a matter of time before Britain recognized Southern Rhodesia’s independence. Fearing this, local leader Ian Smith declared unilateral independence in 1965 under continued white rule. The declaration drew backlash both domestically and internationally, and a war against white minority rule broke out at home. After the war, a peace agreement was signed in 1979, a ceasefire followed, and the country formally gained independence as Zimbabwe in 1980. Robert Mugabe, leader of ZANU, one of the main forces seeking independence, won the election and became the first prime minister of independent Zimbabwe. Although Mugabe initially suppressed opposition groups by military means, he also showed a focus on the public interest and actively pursued initiatives in education and health. Manufacturing and agricultural exports increased domestically. Later, the political system shifted from a parliamentary cabinet system to a presidential system, and in 1987 he assumed the presidency.

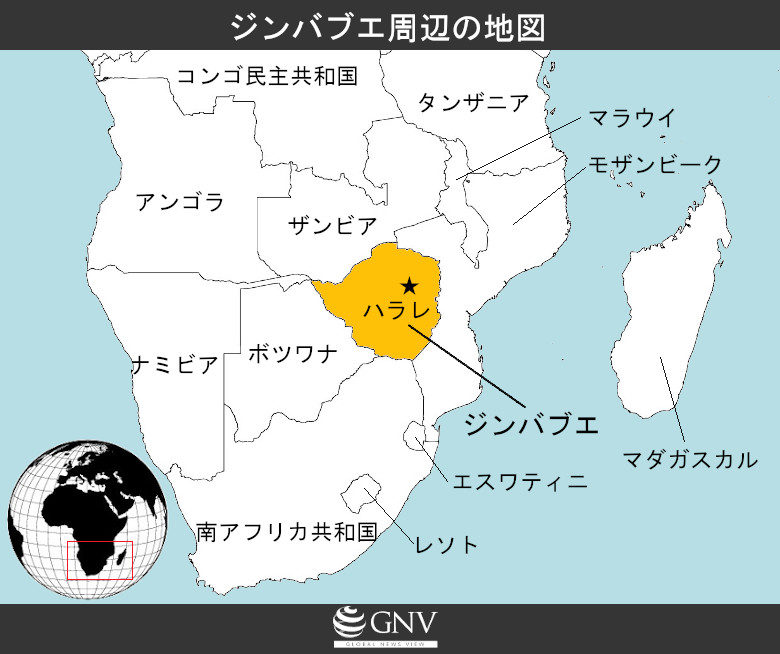

[Based on a map by Vemaps.com]

What appeared to be a smooth-sailing Mugabe administration dramatically changed Zimbabwe’s economic situation due to policies implemented in the 1990s. Aiming to correct the situation in which whites owned most of the land due to colonial rule, the government launched land reform. As part of this reform, in 1992 it enacted the “Land Acquisition Act,” which allowed the government to compulsorily purchase land from landowners. However, faced with strong opposition from white landowners and the refusal of compensation funds requested from Britain for land redistribution, Mugabe adopted a hardline stance. In 2000, with government backing, many veterans of the liberation war occupied white-owned land and expelled the owners. This land reform forced many white landowners to abandon their land and, as a result, agricultural output dropped significantly.

Moreover, the dispatch of troops to the war in the Democratic Republic of the Congo in 1998 further worsened the economic situation. Subsequently, two years of poor harvests and drought led to famine. As exports declined along with agricultural production, Zimbabwe’s fiscal situation deteriorated, and the central bank printed more money to secure funds for imports, which in turn triggered inflation. Zimbabwe’s inflation rate surged into hyperinflation, reaching a peak of over 200 million percent in 2008.

President of Zimbabwe Robert Mugabe in 1982 (Photo: Hans van Dijk · Anefo/Wikimedia [CC0 1.0])

Zimbabwe in economic crisis

As the economy deteriorated and inflation peaked, Zimbabwe decided in 2009 to abandon its currency, the Zimbabwean dollar. It then began conducting transactions using nine foreign currencies (Note 1), primarily the U.S. dollar, as stipulated by law. This decision initially showed signs of economic recovery, but it did not last. Due to declining exports, reduced investment, and the effects of drought, the country again fell into a severe economic crisis. To ease the cash shortage and prevent capital flight, in 2016 the government announced it would begin printing bond notes. Although the government initially stated they were pegged at par with the U.S. dollar, it failed to gain public trust, their value fell, and inflation again became a problem.

Amid this, a military coup occurred in 2017. As a result, the long-standing Mugabe administration collapsed, and Vice President Emmerson Mnangagwa replaced the then 93-year-old Mugabe as president. Subsequently, labor unions demanded salaries be paid in foreign currency, but in 2019 the government decided to ban the use of foreign currencies and reintroduce the Zimbabwean dollar. However, the currency’s value plummeted again, and inflation returned. Prices continued to rise due to inflation, with acute shortages and soaring costs particularly for fuel, food, and medical supplies. In this context, cryptocurrencies gained attention as a means to improve the country’s worsening economic situation. More people began using them on the belief they offered far more stable transactions than the domestic currency, which had lost public trust and continued to lose value.

A woman holding a bundle of 10-trillion-dollar Zimbabwean banknotes (Photo: DJANDYW.COM AKA NOBODY/Flickr [CCBY-SA2.0])

What is cryptocurrency?

So what exactly is cryptocurrency? Cryptocurrency is a currency that can be used for transactions on the internet and, unlike conventional currencies, does not exist in physical form. Representative cryptocurrencies include Bitcoin and Ethereum. A crucial technology for understanding cryptocurrency is blockchain. This is the core technology underpinning cryptocurrencies and is responsible for recording cryptocurrency transactions. Blockchain has several features.

First, its biggest feature is that transactions are managed in a distributed manner across multiple computers. By making transaction data public on the network, this distributed management is possible; managing data across multiple computers avoids concentrating authority in one place. It also makes it easier to eliminate data tampering and fraudulent records. Furthermore, unlike fiat currency transactions, there is no need to go through banks or financial intermediaries, so their involvement can be excluded and transaction costs can be reduced. Similarly, it is possible to avoid government intervention and the effects of policy, enabling stable transactions. In addition, because cryptocurrencies exist online, there is no need to physically mint currency.

On the other hand, there are weaknesses. First, their value is highly volatile. The total issuance of many cryptocurrencies is predetermined, and prices are determined by supply and demand relative to that. As a result, prices are constantly fluctuating. Moreover, because many people treat cryptocurrencies like stocks as instruments for financial trading and speculation, prices can swing sharply. The 2nd is that they cannot be used unless accepted by merchants. Unlike fiat currencies overseen by a central bank, cryptocurrencies will not function as a means of payment unless merchants recognize their value. Thus, their use as a payment method is limited. The 3rd is that regulation remains underdeveloped. Cryptocurrencies carry risks of being abused for fraud, hacking, and money laundering. While regulations and laws are needed to mitigate such risks, few countries or regions have robust systems governing cryptocurrencies, and their legal status is often unclear, making their use risky. In this way, while cryptocurrencies offer many advantages, there are also issues that must be addressed for their use.

Cryptocurrency price index (Photo: QuoteInspector [CC BY-ND 4.0])

The rise of cryptocurrencies in Zimbabwe

Because Zimbabwe has fallen into a dire economic situation, cryptocurrencies have come to be widely used among its citizens. With the government-backed currency plunging in value and cash in short supply, people saw cryptocurrencies as having more stable value and enabling transactions. What, then, are the concrete developments in the adoption of cryptocurrencies within Zimbabwe? One notable move was the introduction in 2018 of Bitcoin ATMs by Golix (Golix), a company providing cryptocurrency exchange services in Africa. A Bitcoin ATM is an ATM that allows you to buy and sell Bitcoin, which is usually done through a cryptocurrency exchange. This seemed likely to further accelerate domestic cryptocurrency use, but the Reserve Bank of Zimbabwe, fearing risks such as fraud, money laundering, and tax evasion, banned the use of cryptocurrencies. However, the ban was later temporarily lifted by the Supreme Court. As a result, rather than diminishing, the use of cryptocurrencies has continued, and several new cryptocurrencies in addition to Bitcoin have been introduced domestically.

For example, there is a cryptocurrency called SPURT (SPURT). This is a community-designed joint project in which those participating in farm work or construction receive SPURT instead of cash (Note 2). As of 2019, about 40,000 Zimbabweans were using this cryptocurrency, but few shops and companies recognize its value as a currency, and opportunities to use it are limited. However, purchases within the community are possible, and it benefits users in those transactions. Another cryptocurrency that drew attention in Zimbabwe after its 2019 launch is Zimbocash (Zimbocash). To prevent extreme volatility from external speculation, only Zimbabweans can register and use this cryptocurrency, and upon registering, users can receive a certain amount of the currency free of charge. This encourages many Zimbabweans to use it, and as usage spreads, the currency’s value can be stabilized. Thus, although not approved by the government or banks, various cryptocurrencies have emerged and started to be used in Zimbabwe.

Reserve Bank of Zimbabwe (Photo: Baynham Goredema/Wikimedia [CC BY 2.0])

Can cryptocurrency save Zimbabwe?

While cryptocurrencies are popular in crisis-hit Zimbabwe and their usage is increasing, they cannot serve as a solution to the country’s economic situation unless issues such as price volatility and the lack of regulatory development, as mentioned in this article, are addressed. Globally, a major step toward solving these issues came in 2019 in the United States, when the (Financial Action Task Force: FATF) set and announced new international standards on the use of cryptocurrencies. In response, countries around the world have begun moving toward cryptocurrency adoption. Even Zimbabwe, which banned the use of cryptocurrencies in 2018, announced in October 2020 that it was preparing cryptocurrency regulations to allow companies to transact with banks in compliance with national financial regulations announced. As countries take a positive view of introducing cryptocurrencies and advance regulatory development, the possibility is increasing that cryptocurrencies will become mainstream in finance.

The problems surrounding cryptocurrencies are gradually moving toward improvement, and various countries will likely take steps toward formal adoption. Zimbabwe is one of those countries. However, even if cryptocurrencies are approved and formally introduced domestically, that does not mean Zimbabwe will be able to escape its dire economic situation. While cryptocurrencies are expected to serve as one stepping stone toward a solution, we must not forget that improving Zimbabwe’s economic situation will require not only the introduction of cryptocurrencies and policies, but also improvements in economic activity itself.

Note 1 The 9 currencies are the U.S. dollar, Australian dollar, South African rand, Botswana pula, euro, British pound, Japanese yen, Chinese yuan, and Indian rupee.

Note 2 SPURT is managed by a company called Sound Prosperity, and SPURT is paid as compensation according to the time spent working on the company’s projects.

Writer: Hisahiro Furukawa

Graphics: Yumi Ariyoshi

Reporting assistance: Hitomi Yamamoto (Xtheta)

仮想通貨についての勉強になりました。

仮想通貨が経済危機に瀕している国を救うきっかけになりうるというのは新しい視点でした。

仮想通貨そのものについても丁寧に説明されていたのでとても分かりやすかったです!

仮想通貨がどんなものなのかイメージが難しかったですが、アフリカの国がビットコインなどの新しい通貨を導入している実態に驚きました。安全性などが不安ですが、経済的発展を促す一つの契機になればいいな、と思いました。